The fast, free, and

easy way.

Start requesting your personalized car loan quotes in just minutes.

The fast, free, and

easy way.

Start requesting your personalized car loan quotes in just minutes.

Golden years we’ve passed!

You can depend on us to get good services

Car Cash India is a one-stop solution for all your car finance needs. We have partnered with India’s leading financiers to help you get a loan for all your needs. We provide you with door-step assistance making the process hassle-free and quick.

FAIR TRADE & ETHICAL BUSINESS PRACTICES : -

At Car Cash India, we do not charge any service fees from our clients. If you encounter anyone demanding money on our behalf, please treat it as fraudulent and refrain from engaging with such individuals. Car Cash India operates as a direct selling agency, offering car loan and car insurance assistance to customers through various Banks, NBFCs (Non-Banking Financial Companies) and Insurance Companies. Please note that we are not a bank or an NBFC but a facilitator committed to connecting you with the best financial solutions.

Areas We Specialize

Used Car Laon

Loan Against Your Car

Top-up/ Balance Transfer

New Car Loan

Car & Two -Wheeler Insurance

Save More with Exclusive Offers

Save more on your car financing with Car Cash India! Explore our expert-guided solutions for new car loans, used car loans, and loans against cars, tailored to fit your budget and needs.

Used Car Loan

Top-up/ Balance Transfer

New Car Loan

Car & Two -Wheeler Insurance

Don’t misread here we have random & interesting facts.

Unbiased view

Convenience

Transparency

Simplified & Speedy process

Clients

Team member

Client’s feedback

Our expert team will assist you.

Salaried and Self-Employed

Eligibility Criteria

- Nationality : Indian

- Age : 18 to 80 Years*

For Salaried Employees

- Work Experience : Minimum 1 year

- Monthly Salary : Rs. 20,000 or more

For Self-Employed Individuals

- Income Proof : ITR for last 2 years

Documents Required

| Documents | For Salaried Individuals | For Self Employed Individuals |

|---|---|---|

| KYC documents (Address Proof, Photo etc) | (✓) | (✓) |

| PAN Card | (✓) | (✓) |

| Salary Slip (latest 3 months) | (✓) | |

| Salary account statement(latest 6 months) | (✓) | |

| Registration Certificate of the car | (✓) | (✓) |

| Last 2 years complete ITR as proof of income | (✓) | |

| Current or savings account statement(latest 6 months) | (✓) | |

| Business Proof | (✓) |

Compare quotes and get car loan in right way

Start a fast, free new car loan, used car loan & loan against your car quote with Car Cash India. We help you find loan that are right for you, so you’re not paying for anything you don’t want!

Get a quote – typically in few minutes. Connect with Car Cash India for your car loan & insurance assistance from a brand you can trust.

We are very happy for our client’s reviews

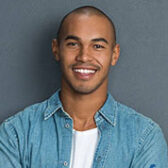

Shyam Sunder

Neha Tyagi

Siddarth Jain

Rakesh Kumar

We're ready to share our latest useful articles.

We build strong relationships that drive the next phase of your journey toward owning a car. By understanding your needs and connecting you with the best loan options, we make car financing seamless and rewarding.

- August 5, 2024

- cciadmin

Loan Against Your Car: Unlock Hidden Value in 5 Simple Steps

- March 15, 2024

- cciadmin

Used Car Loans Made Easy: Tips for Affordable Financing

- February 25, 2024

- cciadmin

New Car Loan Guide: How to Get the Best Loan Rates in 2024

Frequently Asked Questions

1 - How much loan can I get on a used car?

2 - What is the process of transfer of ownership after my loan is sanctioned?

3 - What is a loan against a car?

4 - What will be the RTO charges and who will bear them?

5 - Is the rate of interest negotiable?

Yes, in the case of most lenders, the rate of interest is negotiable if one has a good credit score, has been regular with your previous payments or a loyal customer of the bank.

6 - Do I need a loan guarantor or a co-borrower for availing a car loan ?

You can avail a car loan on your own. However, you might need a guarantor or a co-borrower if you do not meet the eligibility criteria like credit score, age, income among a few others.

7 - Do I need collateral for a car loan ?

In a new car loan, the car acts as a collateral. Hence, a car loan does not require any additional collateral. You must, however, have the car’s registration certificate endorsed with the bank. This hypothecation is revoked once the loan has been fully repaid.

8 - How much time is needed for the loan process?

Ideally the process takes 1-3 working days. However in adverse situations depending on the lender and customers documents, it can stretch as well. Our team will keep you updated on the process.

9 - How is car insurance premium calculated?

The premium price of third-party car insurance plans is determined by the IRDA, whereas the premium for standalone own-damage and comprehensive plans vary from insurance company to insurance company. Some factors which affect the premium for own-damage four wheeler insurance cover are Insured Declared Value, Engine Cubic Capacity, Age of the Car, Make, Model and Variant, RTO Location.

10 - Is car/tw insurance mandatory in India?

As per the Indian Motor Tariff, every car/tw owner in the country is compulsorily required to own at least a third party cover. Absence of a valid plan is a punishable offence which attracts a fine and/or imprisonment.

Our banking partners and insurance partners